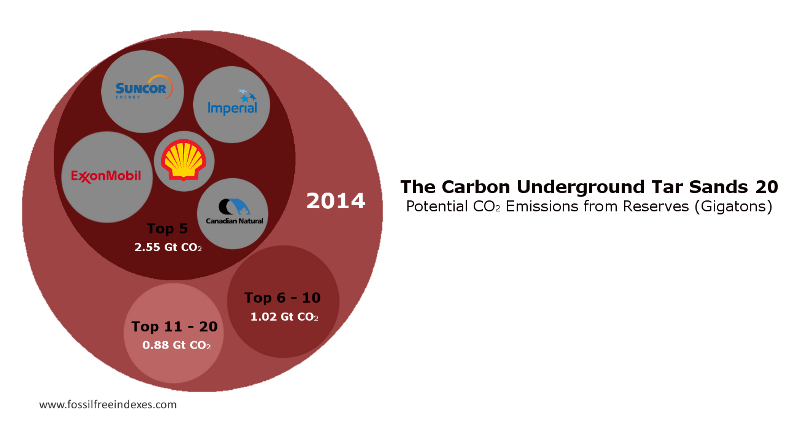

Big news for the divestment campaign. Fossil Free Indexes, the firm that maintains the “Top 200 Coal, Oil, and Gas Companies” list (The Carbon Underground 200), has produced a list of the top Tar Sands companies – The Carbon Underground Tar Sands 20. Why 20 you ask? For the same reason there are 200 on the 200 list; it’s a nice round number that covers the vast majority of the potential carbon. The top five companies on the list, are ExxonMobil, Suncor Energy, Imperial, Canadian Natural, and Shell Oil. Now we can better unite the divestment movement and the long-standing infrastructure fights against Tar Sands (e.g. Stop The Keystone XL Pipeline campaign).

As institutional investors explore the spectrum of divestment strategies, the question of “the worst actors” inevitably arises. That is ostensibly what the Stanford coal divestment was modeling. When considering stranded assets, we know coal is a higher risk than oil or gas. But, we also know that high-cost unconventional oil & gas productions are right there with coal as a high risk for significant devaluation or stranding. From a financial perspective, a list of companies holding the bulk of Tar Sands assets is a valuable tool for risk mitigation.

And of course from a climate perspective, these companies are public enemy number one [through 20]. As Fossil Free Indexes reported, “Turning tar sands into gasoline requires so much energy that the overall emissions burden is more than 17% greater than gasoline made from conventional crude oil.” Tar Sands production not only generates more carbon, but reserves have grown much faster than conventional oil and gas overall. According to FFI’s report, Tar Sands potential reserves-based emissions have grown 435% since 2004. That’s compared to a gas growth of 28.7% and a conventional oil growth of 19.5% during the same time period. Here’s what the dramatic graph looks like:

As you may have noticed, Exxon is at the top of the Tar Sands list. Exxon is at the top of a lot of lists, which is why it is an investment anchor for the oil industry. What the Tar Sands 20 data shows, is that Exxon is sitting on the largest pile of high-potential stranded assets – which is a solid argument to detach from the anchor.

How can divestment campaigns leverage this new information? Well, there is a strong case to be made for Canadian divestment campaigns to add extra movement emphasis on the Tar Sands 20 list. Campaigns across the globe can use this list to help their target trustees understand how stranded assets are like a row of dominos, and Exxon and other Tar Sands companies are the first 20. With that being said, there are 180 more companies saturated in stranded asset risk that hold enough CO2 to fry the planet. The Tar Sands list is more detail for the discourse, and should provide more motivation for a full 200 divestment.

To get more information about the Tar Sands 20, go to the Fossil Free Indexes webpage on Tar Sands.

I hope this is helpful. Best of luck to all the campaigns.

Brett

Senior Analyst, 350.org