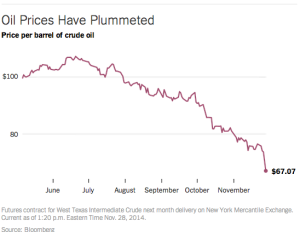

The headlines last week were all about oil prices. You may have seen articles talking about the geopolitical boondoggle the OPEC countries are in. You may of heard speculation about a sluggish economy or how consumers at the pump are jumping for low-price joy. But what does it mean for the divestment movement that crude oil prices have dropped off a cliff?

First: no oil producer is safe from stranded assets or the carbon bubble. Until now, trustees and opponents of divestment have pointed out that the majority of the fossil fuel reserves are not assets on the public market. This is true, much of the oil in the ground, waiting to be sold, is state owned. But, according to the IMF, there is a relatively specific oil price countries need the markets to maintain in order to balance their budgets.

“At one end were Kuwait, Qatar and the United Arab Emirates, which can break even with oil at about $70 a barrel. At the other extreme: Iran needs $136, and Venezuela and Nigeria $120. Russia can manage at $101 a barrel,” the IMF said. Oil is now below that breakeven point for many of the OPEC countries. With the energy economy in great transition, it’s going to be a rough ride for anyone holding fossil fuels (which is what we’ve been telling investors).

Second: low oil prices are bad news for high production costs. It’s economics 101. Many of the big oil producers have ventured out into what is called “unconventional” oil production. This is the big risky stuff you hear about on the news all the time: deepwater drilling, Arctic drilling, and tar sands.

Carbon Tracker produced a report on this earlier this year, saying “There is an estimated $1.1trillion of capex earmarked for high cost oil projects needing a market price of over $95 out to 2025.” So many of the oil majors are going to find themselves asking whether or not they feel lucky enough to continue projects like KXL. Which is not a question low-risk investors feel comfortable with. If oil prices remain low long enough, those projects will end up stranded. And yes, it will affect your pension or endowment.

Third: this price plunge is a reminder to investors that oil is inherently volatile (Or at least it should be a reminder). The price of oil may continue to plunge, or it may shoot right back up – or, most likely, it may go up and down over the long term. All of these ups and downs – that is, the volatility of the price – is a risk for institutional investors. Here’s a graph from the market news site The Motley Fool:

“What you are looking at is the percentage change in the price of oil over the past few decades. That chart tells us that oil prices are borderline crazy. Rocketing to all-time highs one moment only to fall back to Earth soon thereafter. What this chart is really telling us is that when it comes to oil prices we should expect prices to do unexpected things when we least expect it.”

Finally: a low price on oil isn’t unequivocally good news for the divestment campaign. As we blogged about in October, there are concerns about how low oil prices can make consumers complacent about transitioning away from fossil fuels. The payback on electric cars, energy-efficient appliances, or installing rooftop solar may not be as immediately enticing for consumers when oil prices are low. The only certainty is that the drop in oil prices means risk for investors, and the most responsible thing to do is divest.