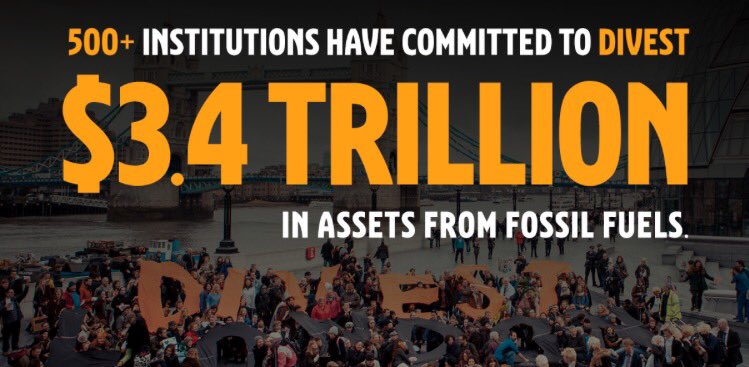

The divestment movement has been gathering pace and building momentum ahead of the climate summit in Paris, where we announced today that more than 500 institutions representing over $3.4 trillion in assets have made some form of divestment commitment.

On 21st September, we were at 400 institutions representing $2.6 trillion under management. In the past ten weeks, more than 100 institutions made new commitments to divest from fossil fuels.

It’s hard to keep track of all the divestment developments at this fast pace, so here are some of the recent highlights from Europe:

- Paris, Lille, Bordeaux and 17 other local authorities* in France have passed motions to put pressure on their fund managers Caisse des Dépôts – France’s most important public investor – and the national pension fund to divest from fossil fuels. * Allonnes, Champagne-Ardennes, Cherbourg, Colombes, Département de la Gironde, Dijon, Hellemes, Hénin Carvin (coal only), La Ravoire, Montreuil, Saint Denis, Région Bourgogne, Région Ile-de-France, Région Poitou-Charente, Région Rhône Alpes and Rennes, and the first district of the city of Lyon.

- The French national assembly adopted, on the 25th of November, a motion that encourages public investors, companies and local authorities to no longer invest in fossil fuels. The motion opens up plenty of opportunities to put pressure on public investors such as the French pension funds.

- The world’s biggest insurance company Allianz announced its plans to pull the plug on investments in companies that make more than 30% of their revenue from coal and increase investments in wind energy.

- The divestment movement is not only stirring up Paris but capital cities across Europe:

- Norway’s capital Oslo announced they will divest.

- Stockholm and Amsterdam are reviewing their investments in fossil fuels.

- Delegates from all parties at Germany’s capital Berlin called for divestment from fossil fuels.

- Mayoral candidates in London are positioning themselves on the question in response to a vibrant divestment campaign in the UK’s capital.

- Münster became the first German city to join the divestment movement. The city has since been swamped with queries from other German cities that want to follow Münster’s example.

- The first church in Germany committed to drop investments in coal, oil and gas too: the Protestant Church in Hesse and Nassau will make its investments worth €1.8 billion fossil free.

- After campaigners released details on the fossil fuel investments of local authorities across the UK, there are now 50 divestment campaigns in cities across the campaign. Cambridge, Kirklees and Norwich passed motions supporting divestment and calling on their pension funds to divest. South Yorkshire Pension Fund adopted new investment policies that exclude ‘pure’ coal and tar sands companies.

- Uppsala not only committed to divest but challenged the three bigger Swedish cities to follow its example.

- Dutch pension fund PFZW announced it will divest from coal companies and reduce its investments in other fossil fuel companies. The fund has €161 billion of assets under management. Meanwhile, Fossil Free ABP campaigners are in consultation with Dutch pension fund ABP after it announced a new sustainability policy, which will cut fossil fuel investments somewhat and increase investments in renewable energy.

- Dutch banking group ING decided to no longer finance new coal power plants and thermal coal mines, and companies whose business is more than 50% reliant on such projects.

- On the first day of the climate negotiations in Paris, the University of Sheffield committed to divest its £39 million endowment from fossil fuels. Just last week, the London School of Economics (LSE) committed to divest its £97.2 million endowment from coal and tar sands companies and to not invest directly in any fossil fuel companies. LSE and Sheffield are the latest in a series of 19 UK universities that have started to cut their financial ties with fossil fuel companies, including the University of Surrey, University of the Arts London and Oxford Brookes University. Wolfson College at the University of Oxford with an endowment fund of £42 million decided to divest from coal and tar sands. Fund manager CCLA, which manages investments for six universities, charities, religious organisations and the public sector, excluded coal and tar sands from its investments.

Over the next couple of days, divestment campaigners from all over Europe will arrive in Paris to further strengthen the movement far beyond Paris and the climate talks. Join the Fossil Free Paris convergence!

Below you can watch a brand new documentary about the rise of the fossil fuel divestment movement in Europe and across the globe.