The campaign to divest local councils from fossil fuels is making waves. The overwhelming majority of local governments’ investments lie in their pension funds (valued at £230 billion in 2015) and by building public and fund member support to put pressure on councils, divestment campaigners are bringing about a major change in how money is invested for the future.

In September 2016, the first UK fund committed to go fossil free: Waltham Forest Pension Fund in London. A handful of funds have made public commitments to move significant portions of money out of fossil fuels and many more have increased their investments in low carbon and ethical funds. Some campaigns have successfully changed policy, won recommendations for further action, or have spurred the creation of new low-carbon investment options.

What kind of picture do these achievements paint? Is there a single path which we need local council pension funds to travel, or must progress be achieved in different ways in different places?

Experience shows that our councils are unlikely to commit to full divestment overnight. Divestment commitments can be made without a policy for pro-active ethical investment (also known as re-investment), and vice versa. We should take care to describe change accurately and not to overstate how far we’ve come, but must also take heart in any progress towards climate-friendly local councils – and as you’ll see below, there has been a lot of progress. Above all, we should learn from experience across the UK to help build an effective movement for change.

Divestment: Fund passes policy to divest from fossil fuels

The following Local Government Pension Funds have all passed motions that commit to full or partial divestment from fossil fuels.

London Borough of Waltham Forest Pension Fund

In September 2016, Waltham Forest Pension Fund became the first UK pension fund to fully divest from fossil fuels. The pension fund is worth £735 million and currently invests £23.9 million in the oil and gas industries.

In September 2016, Waltham Forest Pension Fund became the first UK pension fund to fully divest from fossil fuels. The pension fund is worth £735 million and currently invests £23.9 million in the oil and gas industries.

At a pension fund committee meeting on the 22nd September, there was unanimous support by both Conservative and Labour councillors for the pension fund to ‘exclude fossil fuels from its strategy over the next five years’. The Fund’s Statement of Investment Principles (SIP) will be changed to reflect this. In addition to the divestment commitments, the Fund also agreed to invest particularly in wind energy as well as to ‘seek to make direct commercial property investments in the borough’.

Councillor Simon Miller, chair of Waltham Forest Pension Fund said,

‘Not only does this mean that the fund will not be invested in stranded assets, but will be actively investing in cleaner, greener investments to the benefit of our community, borough and environment.’

The campaign has been led by Divest Waltham Forest campaigners as well as Waltham Forest Friends of the Earth, and has involved demonstrations outside City Hall in London, a petition to the Pension Fund and educational film screenings.

Result: First full divestment!

The Environment Agency Pension Fund

In October 2015, the Environment Agency Pension Fund (EAPF) announced that it would end most of investments in fossil fuels within the next five years.

In October 2015, the Environment Agency Pension Fund (EAPF) announced that it would end most of investments in fossil fuels within the next five years.

The announcement was made with the publication of a new investment policy for the fund, which outlined a goal of ensuring the fund’s investments and processes were ‘compatible with keeping the global average temperature increase to remain below 2°C relative to pre-industrial levels.’

The Fund has around 40,000 members, is valued at £2.9bn in size and invests around £72.5 million (2.5%) in fossil fuels.

The policy included three targets to be achieved by 2020:

- Invest 15% of the fund in low carbon investments.

- Decarbonise the fund’s shareholdings in coal by 90% and oil and gas by 50%.

- Support progress towards a transition to a low carbon economy by working with investors, fund managers, companies, researchers, and political leaders

This new approach reinforces past efforts by the fund to invest responsibly. In 2015 the fund invested £280 million in a new Legal & General fund that follows the ‘MSCI Low Carbon Index’, a list of companies that don’t invest in coal, major oil companies and other fossil fuels, reducing ‘carbon exposure’. The fund also invests £19m in a ‘Low Carbon Workplace Fund’ which lends to energy efficiency programmes for commercial buildings.

Result: (Impressive) partial divestment

South Yorkshire Pension Fund

In November 2015, South Yorkshire Pension Fund committed to low carbon investment policies that exclude ‘pure’ coal and tar sands companies. SYPF is £5.55 billion in size and invests around £317 million (5.7%) in fossil fuels.

On 17th September 2015, SYPF’s Investment Board held a meeting where the Fund agreed that there should be ‘a long term tilt towards a low carbon economy within its portfolios’. It confirmed that there would be no direct investments in pure coal and tar sands companies.

In March 2016, SYPF released a ‘Climate Change Policy’. While the policy stresses that SYPF will continue to engage with fossil fuel companies, it also says that ‘consideration will be given to reducing exposure to high-carbon intensity companies that fail to respond to engagement by not demonstrating a decrease in carbon intensity or carbon risk… Over time endeavour to manage a tilt within portfolios in favour of lower carbon assets in-line with the Paris Agreement, with a view towards progressively decreasing the Fund’s carbon exposure.’ SYPF’s 2015 ‘Responsible Investment Policy’ is here.

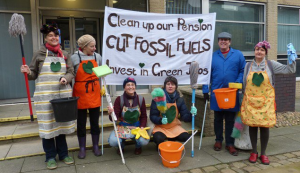

Sheffield Climate Alliance has been running the divestment campaign that has included colourful stunts outside the Pension Authority office, communication with the Fund Director and a long-running petition that has been steadily gathering signatures.

Result: partial divestment

Divestment: Fund employers pass motions backing divestment

The following are examples of subsidiary local authorities calling on their Local Government Pension Fund to divest from fossil fuels. These local authorities do not have direct control over whether divestment takes place as they are only one of several local councils that are part of their Local Government Pension Scheme. However, divestment motions backed by Fund employers are a big step in the right direction and ensure that the Local Government Pension Fund continues to feel the pressure to divest and reinvest ethically.

Oxford City Council

In September 2016, Oxford City Council became the first local authority in the UK to pass a motion on fossil fuel divestment. Oxford City Council pledged to make no direct investments in fossil fuel companies for ethical reasons.

In September 2016, Oxford City Council became the first local authority in the UK to pass a motion on fossil fuel divestment. Oxford City Council pledged to make no direct investments in fossil fuel companies for ethical reasons.

The move was a hugely symbolic victory for the divestment movement, but the structure of the Local Government Pension Fund means its effect has so far been limited. Oxford City Council is one of several local councils who are members of the Oxfordshire Pension Fund that currently invests around £42 million in fossil fuel companies. Divestment would require policy or action to be taken by the Oxfordshire Pension Fund that is managed by Oxfordshire County Council. The Fossil Free Oxfordshire Divestment Campaign is actively pushing for full divestment of the Oxfordshire Pension Fund.

Similar motions and calls for the wider County Council Pension Funds to divest have been passed by Bristol City Council, Cambridge City Council, Hastings Borough Council, Kirklees Council, Norwich City Council and Reading Borough Council.

Result: full divestment (but more work to be done)

Reinvestment strategy is publicly announced

The following Pension Funds have made bold moves to invest their money in more ethical and low carbon ways, using a range of tools and strategies to make this happen.

Greater Manchester Pension Fund

The Greater Manchester Pension Fund, approximately £13bn in size, has made its investments more responsible by investing in joint infrastructure projects and renewable energy.

The Greater Manchester Pension Fund, approximately £13bn in size, has made its investments more responsible by investing in joint infrastructure projects and renewable energy.

In 2014 it partnered with The Homes and Communities Agency to provide £25m in investment funding to build over 200 affordable homes in the Greater Manchester area. It is part of the Investing 4 Growth initiative, a joint project between six local government pension funds that seek ‘investments that have an economic impact as well as positive and environmental outcomes in the UK’.

It has invested £500m in an infrastructure investment partnership with the Lothian Pension Fund Authority, that funds renewable energy projects in the UK, and has a further partnership project with the London Pensions Fund Authority for infrastructure projects in Greater Manchester and London. GMPF has created a ‘special opportunities portfolio’ that enables funds to be allocated specifically to alternative investments like infrastructure.

Around 1% of its total funds to a special portfolio, called ‘Impact Portfolio’ that invests in renewable energy and through this portfolio, £10m has been allocated to UK renewable developer Albion Community Power to develop community scale energy.

Lancashire County Pension Fund

Since 2009, Lancashire County Council (£5bn in size) has diversified its investments, increasing investments in infrastructure (directly with its own staff and indirectly via external fund managers) and property. The majority of the direct investments have been in renewable energy projects and companies in the UK, the US and Australia.

LCPF invested £12m in Westmill Solar Coop, the UK’s largest cooperative. This has been through ‘refinancing’ – investment made after, rather than before, the solar farm became operational making the loan less risky.

In September 2015 LCPF agreed to create a Responsible Investment Policy which will provide a more detailed long-term strategy for investing responsibly.

London Borough of Croydon Pension Fund

London Borough of Croydon Pension Fund

In July 2014, the London Borough of Croydon Pension Fund decided to switch its equity assets of around £350m to a Legal & General (L&G) global ethical investment fund to avoid exposure to tobacco, nuclear power and arms stocks.

London Borough of Haringey Pension Fund

In January 2016, Haringey Council voted to invest two-thirds of its London Borough of Haringey Pension Fund (HPF), around £220 million, in the MSCI World Low Carbon Target Index Fund (a list of companies that don’t invest in coal, major oil companies and most other fossil fuels). HPF has not fully divested from fossil fuels, and will actively ‘engage’ in persuading companies to decrease their carbon emissions.

London Borough of Islington Pension Fund

Islington Pension Fund (IPF) recently announced that 15% of its total fund would be invested in infrastructure and social housing through a new portfolio.

The fund is relatively small in size (£971 million) which means greater financial risks compared to other pension funds, and less expertise in investing in special responsible pension funds. To overcome this issue, IPF is part of a project of London pension funds that are pooling their funds to create a Collective Investment Vehicle that will manage assets worth £24 billion. The CIV will be used primarily for infrastructure investments, and the CIV opens up possibility for individual funds to jointly invest in things like renewable energy or socially-useful infrastructure.

Strathclyde Pension Fund

In 2009, the Strathclyde Pension Fund (around £14bn in size) created a ‘New Opportunities Portfolio’ that invests in ‘alternative’ (or not so typical) types of assets like infrastructure, renewables, housing, smaller property and local regeneration. To date, NOP has invested in financing several small and medium enterprises as well as the construction of the Glasgow Commonwealth Games’ Athletes’ Village. In February 2016, it partnered with the Green Investment Bank and contributed £10m to a £60m investment in community renewable energy projects. This investment will go towards several renewable energy projects including a hydro-electric power station in Western Scotland.

Funds pass ‘enabling’ policies, commit to feasibility studies or review their investments

The following local authorities have passed motions that enable divestment to take place, look in detail at the options and feasibility of divestment and reinvestment, or review their current investments. This can be a key first step to persuading Pension Funds of the different options they have to invest their money more ethically.

Greater Manchester Pension Fund

In August 2015, Greater Manchester Pension Fund (GMPF) ran a consultation on its Statement of Investment Principles (SIP). Manchester Friends of the Earth set up an e-action and got 400 responses in 1 week. The e-action convinced the GMPF’s Pensions Committee to change a key paragraph (8.1) in the SIP from:

‘The Fund holds a general policy of not interfering in the day to day investment decisions of its investment managers and does not actively invest in nor permanently disinvest from companies solely or largely for social or ethical or environmental reasons.’

to the more helpful:

‘The Fund holds a general policy of not interfering in the day to day investment decisions of its investment managers. However, the Fund may choose to actively invest in or disinvest from companies for social, ethical or environmental reasons, so long as that does not risk material financial detriment to the Fund.’

Feasibility studies and investment reviews

In the spring of 2015, City of Edinburgh Council and Glasgow City Council passed resolutions at full council meetings that called for a report to set out the feasibility, costs and benefits of introducing a partial or complete fossil fuel divestment strategy for the Lothian Pension Fund (£5bn in size) and Strathclyde Pension Fund (approximately £14bn), to be reviewed within the context of the funds’ statement of investment principles. Divest Lothian and Fossil Free Strathclyde have been two very active campaigns.

On the 20th October 2015, Bradford City Council passed a motion to review the investments of West Yorkshire Pension Fund in order to assess the necessity and feasibility of divestment, pushed by an active Fossil Free West Yorkshire Pension Fund campaign. Similarly, on the 8th October 2015 York Council agreed to review the investments and investment options of the North Yorkshire Pension Fund.