Fossil Free UK

Guide to Local Government Divestment:

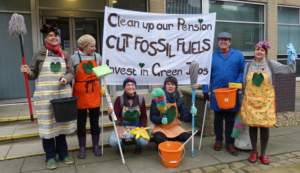

About the campaign

Introduction to local government divestment campaigns

Local councils in the UK manage pension funds worth over £230 billion. £14 billion of this is invested in the fossil fuel industry.

Across the UK and the world, these investments are increasingly being challenged by the fossil fuel divestment campaign. In the UK there are over 30 divestment campaigns targeting local councils and the pension funds they manage.

As public bodies, local councils have a responsibility to work for the public good; they shouldn’t be financially and politically supporting the most destructive industry on the planet.

campaign demands

The basic ask

While investment means buying stocks, bonds or other investments in order to generate financial returns, divestment is getting rid of particular stocks, bonds or investment funds. This could be for financial reasons, ethical reasons, or some combination of the two.

Fossil fuel divestment, therefore, is avoiding direct ownership of, or commingled funds that include, public equities and corporate bonds of fossil fuel companies.

The divestment movement asks institutions holding investments – in this case, local government pension funds – to resolve to:

- Immediately freeze any new investment in the top 200 publicly-traded fossil fuel companies;

- Divest from direct ownership and any commingled funds that include fossil fuel public equities and corporate bonds within 5 years.

Additionally, you could also consider reinvestment asks – these consider how money currently invested in fossil fuels could be reinvested into clean energy, local infrastructure or other public goods. To find out more about reinvestment, check out the Reinvesting Pensions report from Community Reinvest.

Asks for pension funds

If you’re directly targeting a pension fund in your campaign (or institution controlling a pension fund) then the primary ask should be in line with the global divestment demands (listed above).

How can a pension fund go ‘fossil free’?

- For divestment to count, it has to be a policy commitment – not just a (potentially temporary) shift in investment. Most funds will have a ‘Statement of Investment Principles’ – push for the commitment to be integrated into these, or encourage them to adopt a separate ‘Ethical Investment Strategy’.

- The decision probably only needs to be taken by the Pension Committee (rather than a full council).

- Divestment won’t happen overnight – the five year time frame of the global ask acknowledges this. However, for a fund commitment to be meaningful it should assign a definite timeframe or deadline to the decision.

Asks for councils and other bodies

If your target doesn’t control a pension fund (e.g. a city council), there are still divestment demands you can make. The main way of doing this will be passing a divestment motion through full council.

If your target doesn’t control a pension fund (e.g. a city council), there are still divestment demands you can make. The main way of doing this will be passing a divestment motion through full council.

How can a council go ‘fossil free’?

- For a council or other body which doesn’t directly control a pension fund to ‘divest’ it has to fulfil certain requirements:

- The motion passed must call on the relevant pension fund to divest (and pledge to apply pressure on the fund to make this happen).

- It should also commit to adopting an investment policy in line with the global divestment ask.

Why Target Local Government?

The movement for fossil fuel divestment began originally on university campuses, but it has quickly spread. More than 50 pension funds globally have now made divestment commitments, moving millions out of the fossil fuel industry.

So why are we targeting local government in the UK?

1. As public institutions, our local government have a responsibility to look out for the public good.

Our local councils are representatives of our communities and they have a responsibility to act in our best interests. This means doing what they can to prevent climate change – fossil fuel investments are at odds with this.

2. Pension funds should be protecting the futures of their members.

By investing in fossil fuels, local government pension schemes are endangering the futures of thousands of fund members. The fossil fuel industry is an increasingly financially risky sector to invest in – especially for long-term investors like pension funds (see key arguments for more on financial risk).

3. Local government pension schemes control vast pots of investment

Pension funds are among the biggest investment pots in the world. In the UK, local government pension funds are worth over £230 billion, of which £14 billion is invested in the fossil fuel industry – a vast amount of money.

4. We are all constituents of local government, and have access the key decision makers

Local councils are some of the most accessible and accountable forms of government in the UK. No matter where you live, you have a local council representing you and you can have your voice heard.

5. Local government has led the way in the past

During the anti-Apartheid divestment campaign, UK councils were some of the first institutions to use their public profile and divest from South Africa – stigmatising the Apartheid regime and ultimately contributing to its downfall.