Last week, amidst the ongoing climate negotiations were taking place in Bonn, Germany, a group of environmental justice activists from Divest London, Coal Action UK and No Tar Sands intervened at the London headquarters of international insurance companies AIG and Lloyd’s to demand bolder action to move away from coal.

Coal is the biggest single source of CO2 emissions and insurers are uniquely placed to support the Paris Agreement commitment to keep the global temperature rise below 1.5 degrees Celsius.

The action coincided with a new report and scorecard published by Unfriend Coal revealing that while leading insurance companies have already pulled $20 billion out of investments in coal and a growing number are refusing to underwrite new coal projects, more action is urgently needed.

In fact most insurers have yet to do anything to prevent the risk of dangerous climate change. The report finds that no U.S. insurer has taken meaningful action, nor have major European companies.

AIG is one of those insurers, who despite increasing their investment in clean energy, have done very little to divest from fossil fuels and stop underwriting coal.

Lloyd’s fares better on the scorecard as the company has promised to implement a clear coal exclusion policy in the coming months and has published a report this year highlighting the risk insurers face with fossil fuel assets stranded due to climate change.

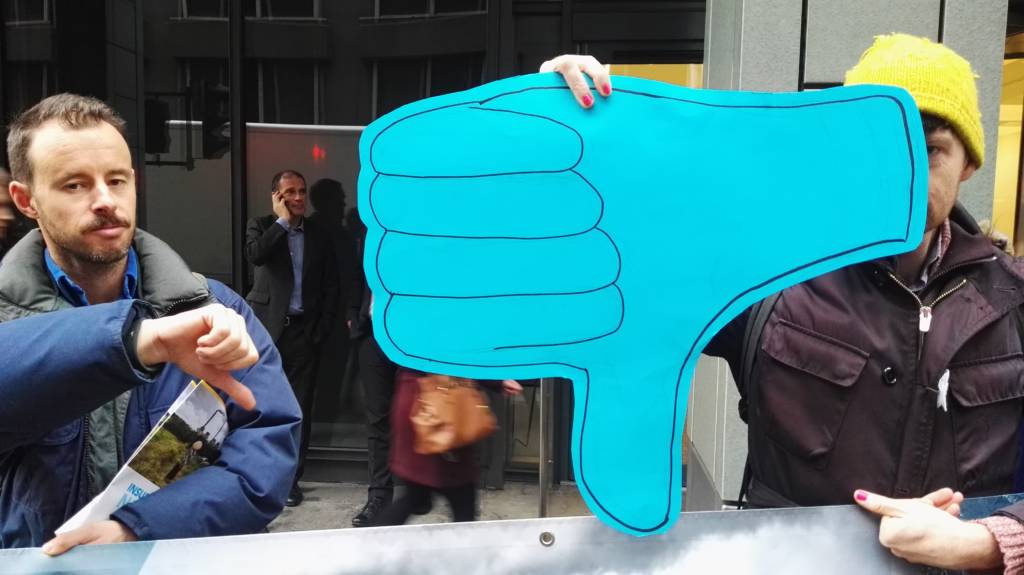

We stood outside the AIG headquarters displaying large ‘thumbs-down’ signs, and outside the Lloyd’s of London building with a cautious thumbs-up, sending a clear message that the people of London want Lloyd’s to make good on their promise at this urgent time for the global community, as well as fully divest from other fossil fuels and step up investment in clean energy.

We offered reports and the score card to Lloyd’s security and staff talks about the Climate Talks taking place in Bonn offered reading material for the staff and encouraged the company to take a strong and swift action if they want to see full thumbs-up!

“London is one of the biggest insurance capitals in the world. With that influence, comes a certain level of responsibility.” said Gabriel Davalos from Divest London.

“If the insurance industry is serious about mitigating risk and protecting their customers, they need to take a long, hard look at the coal projects that they underwrite and the coal companies that they invest in. We’re here to deliver a clear message to the insurance industry – the world’s best insurance policy is to keep coal in the ground.”

This won’t be the last action we have taken on the insurance industry, as the impacts of coal are not limited to CO2 emissions with coal extraction and refining are continuing to devastate communities globally. Most major insurance companies underwrite various stages of the coal supply-chain, including open-cast coal mines.

Anton Lementuev, a resident in the major open-cast coal mining region of Russia, Kuzbass, was heartened to see pressure being put on the insurance industry in London:

“Wherever opencast coal mining projects occur you find human rights abuses, high incidences of health problems and loss of wildlife and ecology. Here in the Russian Kuzbass region we have all suffered all of this because insurance companies were willing to support more than fifty coal mines. Insurance companies should withdraw their support for the coal industry and mines need to be closed.”

The very same morning after the action took place, photos of it were shared by the Unfriend Coal coordinator Peter Bosshard, inside the first London Climate and Insurance Risk Conference.

“If insurers cease to cover the numerous natural, technical, commercial and political risks of coal projects, new coal mines and power plants cannot be built and existing operations will have to shut down. Insurers also manage $31 trillion of assets, and by shifting investments from coal to clean energy they can accelerate the transition to a low-carbon economy” he said.

Throughout the conference it was encouraging to see that the pressure had worked and the insurers were scrambling to show that they all had intentions of putting best steps forward respond to the score card and ranking and make the move out of coal.

Some were even committing to actions before their next annual general meetings, perhaps to avoid any protests appearing on their steps too, even if they were the encouraging kind.

This year we have witnessed the increasing frequency and intensity of extreme weather events due to human-driven climate change. We can no longer wait to act on the climate crisis – the window for inaction has closed.

With climate negotiations in Bonn leaving little teeth for implementation of the Paris Agreement we are looking forward to Lloyd’s making good on it’s own promises for a commitment to move away from coal in the near future, and demand AIG and the insurance industry to rapidly set up to adopt policies that accelerate the move for insurers to divest from and cease underwriting coal in order to join the global efforts to take immediate meaningful action on the climate crisis.

Written by Suzanne Dhaliwal (No Tar Sands) with Divest London and Coal Action Network UK as part of the Unfriend Coal campaign platform.