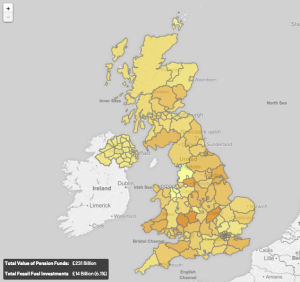

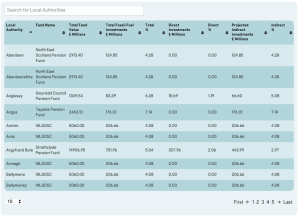

Data released today shows UK councils have invested £14 billion of their pension funds into fossil fuels. That’s £281 for every UK resident, and enough to build over 200,000 new homes, or power Scotland with 100% renewable energy.

This is the first time that the £231 billion investments of all 418 local councils have been broken down and released publicly. The data ranks local councils by their fossil fuel exposure and highlights associated financial and climate risks, and the potential benefits were this money to be reinvested in positive solutions.

“Public investments in fossil fuels are fuelling dangerous climate change, and present a threat to the pensions of 4.6 million public sector workers. There’s a strong ethical and financial case for local councils to divest from fossil fuels and reinvest into infrastructure fit for the 21st century.” – Danni Paffard of 350.org

The map tool allows local people and pension holders to look up the investments of their own council, and encourages people to join the growing movement calling for public institutions to distance themselves from the fossil fuel industry.

The data is released days after the latest divestment figures shows over 400 institutions with an asset base of $2.6 trillion have made commitments to divest from fossil fuels, with the pressure mounting on others to follow suit.

The tool – launched by 350.org, Platform, Community Reinvest and Friends of the Earth – is part of the wider grassroots campaign putting pressure on local government to divest from fossil fuels, with groups around the country working to get divestment commitments from councils, and twelve new groups launching this week alone.

“Local residents and pension-holders won’t be happy that their money is funding climate change. Today we’ll be calling on Greater Manchester to stand on the right side of history and divest from fossil fuels.” – Ali Abbas, Friends of the Earth Manchester, launching a campaign today targeting the Greater Manchester Pension Fund.

Already 50 local governments globally have spoken out about divestment, with increasing attention higher up the food chain directed at local government pension funds. In June groundbreaking state legislation passed to divest California’s public pension funds CalPERS & CalSTRS – the largest public funds in the country – from certain coal companies. This came weeks after analysis showing a combined loss of over $5 billion in the last year alone from their holdings in the top 200 fossil fuel companies.

“We don’t want fossil fuels to destroy our pensions, and we don’t want our pensions to destroy everyone’s future.” – Jane Ivimey, a pension scheme member and part of Fossil Free Oxfordshire

The £231 billion managed by councils is the combined pension pots of 4.6 million public sector workers. Investing in fossil fuels companies risks people’s savings and contributes to potentially devastating climate change.

Our local governments have led they way in the past, and played an important role in the divestment campaign against the racist apartheid regime in South Africa. Remaining invested in fossil fuels also undermines the good work and commitments many councils have made to tackle climate change.

We hope the tool is a call for local authorities everywhere to take a lead on climate action and divest from fossil fuels, and for constituents and pension holders everywhere to demand it of them.

Find a campaign near you to get involved, or get something started in your area.