By Katrine Ehnhuus, Danish divestment campaigner

For six months now, the divestment campaign in Denmark has worked hard to get Danish municipalities to divest. A few months into our campaign, we realized that we needed an overview of Danish municipalities’ investment policies. We simply did not know which municipalities invested in fossil fuel companies and which municipalities did not. We decided to create a public list of municipalities that rated them as green, grey or black depending on their investment policy.

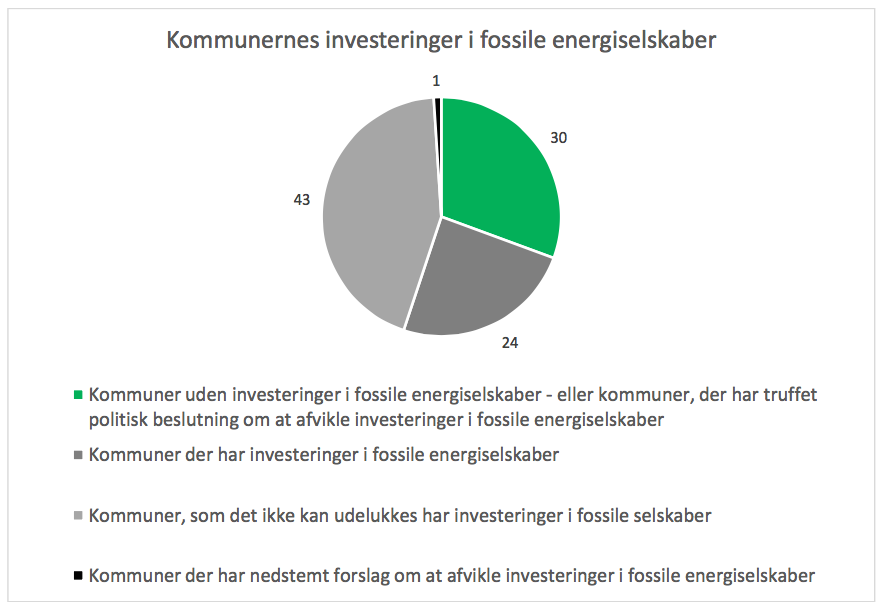

We wrote to all 98 Danish municipalities asking them whether or not they invest in fossil fuel companies. Our results are displayed in the chart below.

Green = municipalities that have no investments in fossil fuels or committed to divest; grey = municipalities with investments in fossil fuels and those that have not responded to the survey; black = municipality that declined to divest. Source: http://ansvarligfremtid.dk/Kommune/Resultater – Survey from 22nd March 2016

The public list had two main purposes: 1) create an extra incentive for the municipalities to divest because they would like to be displayed on the green list, and 2) create a tool that would enable us to choose which municipalities to focus on.

However, the survey also turned out to have several positive side effects:

- We raised awareness of the campaign among all municipalities

- In order to answer our questions, several the municipalities asked their investment fund manager about their fossil fuel investments, and thus expressed a demand for fossil-free investment options

- Several municipalities became inspired to take steps towards divestment

- The Danish media was interested in the survey and it became a widespread news story

We also realized that the biggest obstacle we face is not to convince municipalities to divest but to get the banks to change.

Investment rules for Danish municipalities: In Denmark, municipalities are allowed to invest in Danish government bonds and real estate bonds. They are not, however, allowed to invest directly in companies. In order to invest in company bonds/stocks/shares, the municipalities are obliged to invest their money through investment funds managed by banks. Currently no investment fund manager in Denmark offers fossil-free investment funds to the municipalities.

Three municipalities committed to divest: Roskilde, Copenhagen and Fredericia

Roskilde was the first municipality in Denmark that committed to divest from fossil fuels. However, due to the circumstances described above, the municipality has not yet been able to implement its divestment policy. Their investment manager, Nordea, refuses to offer them a fossil-free investment option.

In February Copenhagen’s finance committee agreed to divest. Copenhagen is very ambitious in relation to its green transition and works hard to become the world’s first CO2-neutral capital by 2025. Obviously, the capital’s green ambitions do not go well with fossil fuel investments and the mayor therefore took the right steps towards divestment. Unlike all other Danish municipalities, Copenhagen manages its own investment fund. Consequently, Copenhagen will be able to implement its divestment policy by transferring its money from other investment funds to its own. We expect the implementation plan to be very ambitious and that it will be adopted in the city council later this month.

In March, Frederica municipality also decided to divest. The municipality has chosen to withdraw all its money from investments funds and solely invest in government bonds and real estate bonds to ensure a fossil free investment policy. It’s an interesting example because Frederica is a big oil harbour town, where the Danish North Sea oil is being shipped out from.

Municipalities, not banks, should be in charge of local climate policy

The one municipality that voted against a proposal for divestment, did it because the banks would not offer a fossil-free investment option. The mayor argues that it would therefore have been populistic to vote in favour of the proposal, since it would be impossible to implement.

Likewise, in the third largest city of Denmark, Odense, the mayor assures us that they demand fossil-free investment options. However, due to the fact, that no bank offers fossil-free options to the Danish municipalities and that Odense would lose too much money in return rates, if they were to only invest in government and real estate bonds, the city has made a less ambitious compromise. The city council has decided to exclude companies, whose primary income comes from coal or tar sand production.

No municipality in Denmark has publicly stated that it wants to invest in the fossil fuel industry. On the contrary, it is our impression that most of the municipalities want to divest. However, the banks are not so easily persuaded. They still won’t offer fossil-free investment options to the municipalities, and this is stopping many city councils from taking the important steps towards divestment.

We, therefore, need to put immense pressure on the Danish banks. We encourage more and more municipalities to express their demand for fossil-free investment options. We encourage the municipalities to unite on this issue. And finally we ensure that the banks also feel the pressure through the Danish media.

Municipalities have a responsibility towards their citizens to manage the money they are entrusted with responsibly and in the public interest. As the money owners, they have a responsibility to put pressure on the banks as their fund managers to invest their money for the public good. We believe that the Danish municipalities – the local democracies – should be in charge of their climate policy, not the banks.