Once again, the oil industry is doing its best to spin the data and hide the whole picture to further its agenda. This time, they are working to build the case that investors will lose money if they divest from fossil fuels. Spoiler alert: we think this is disingenuous, to say the least.

In August, the petroleum industry commissioned a study that found significant loss for university endowments that had (hypothetically) divested 20 years ago. Today, the fossil fuel industry published a U.K.-focused report displaying “underperformance” by a fossil fuel divested market between 2002 and 2014.

There are three important things divestment campaigners — and, more importantly, investors — should know when reading these reports (other than the fact these reports are produced by the oil industry):

1) The political, market, and social equation is very different today than it was 10 years ago.

Past performance is not a predictor of future results. In this case, it may be inappropriate to look too far back. Carbon focused restrictive legislation and national/ international carbon cutting goals have ramped up over the last few years, and are on track to dramatically restructure the industry.

Demand is also shifting in a big way. With energy efficiency integration and the trajectory of competitive alternatives, fossil fuels have a bleak future on the demand side. The supply side isn’t any better. The industry steadily shifted from high-return, low-cost conventional projects (your classic oil well), to high-cost, capital-intensive, complex projects — like LNG, tar sands, and Arctic drilling.

These recent political and market shifts are all being driven forward by a dramatic social shift. Climate change is now a primary social concern. Divestment is an expression of that social concern, creating industry stigmatization — a material risk for fossil fuel companies.

Perhaps an appropriate “backtest” would be one that begins on the date when the divestment movement started calling for smart, diligent, and strategic divestment.

2) It’s easy to cherry pick timelines.

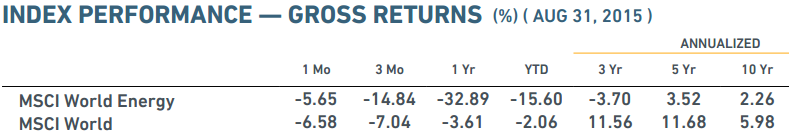

Fossil fuel companies may have been “good performers” from 2002 until 2010, largely because of rising oil prices during that period. But over 1, 3, 5 and 10 year periods, the fossil fuels (the energy sector) has underperformed the world markets, as the chart below shows. When the oil industry wants to show the strength of fossil fuel stocks, it just needs to pick the right time periods. If you go back 22 years, a divested portfolio wins; 20 years a un-divested portfolio. Both are true — and both are irrelevant to the future.

Source: The MSCI World Energy Index fact sheet.

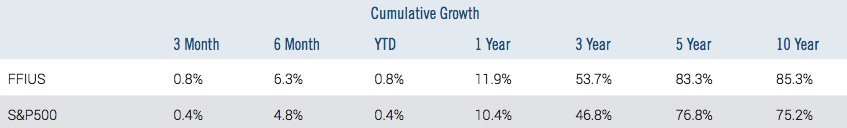

The other way to look at this, as the oil industry papers do, is how hypothetical divested portfolios would have performed over time (as opposed to looking at the returns of fossil fuel stocks). The story is the same, it all depends on the time period you examine. In the chart below you’ll see the Fossil Free S&P 500 (produced by Fossil Free Indexes) compared to the S&P 500.

Note: This chart shows historical data of the S&P 500 (the top 500 companies in the US) over the last 3 months to the last 10 years. This is compared to FFIUS, which is the S&P 500 without to top 200 fossil fuel companies. Source: Fossil Free Indexes [.com]

Note: This chart shows historical data of the S&P 500 (the top 500 companies in the US) over the last 3 months to the last 10 years. This is compared to FFIUS, which is the S&P 500 without to top 200 fossil fuel companies. Source: Fossil Free Indexes [.com]

In short, both sides of the debate could go back and forth with different timeline backtests all day. Eventually, we need to start asking the question: What does the future look like?

3) While the oil industry is saying you’ll lose money if you divest, investors are actually losing money because of their oil investments.

Over the past year, oil stocks have underperformed to general market by over 30 percent, and over the past three years they’ve underperformed by over 20 percent. This percentages translate into real dollars.

From the day the Fossil Free California campaign began, California’s two huge pension funds have lost $5.1 billion on their fossil fuel holdings. Massachusetts’ state pension lost $521 million on oil, coal and gas holdings between June of 2014 and June of 2015.

Speculate all you want; since the call for divestment began, fossil fuels are costing investors REAL returns.