Ninety-two leading banks last year provided at least EUR 66 billion in financing to the coal industry, according to new coal financing data released today in BankTrack’s ‘Banking on coal 2014‘ report. This represents a ‘record year’ for financial support extended to the top 65 coal companies in both the coal mining and power sectors, at a time when investments should be declining rapidly.

Released just days ahead of the publication of the fifth United Nations Intergovernmental Panel on Climate Change (IPCC) assessment report, the EUR 66 billion figure represents a more than fourfold rise in climate-busting coal financing when compared to 2005, according to BankTrack’s research.

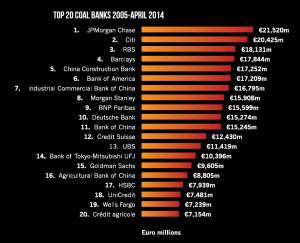

Analysing what is now one of the primary forms of life support for a global coal industry in crisis, the new report also reveals that leading banks have provided 373 billion euros (500 billion dollars) in financing for the coal industry between 2005 and April 2014. The top 20 financiers, including JPMorgan Chase, Citi and RBS in the top three, have alone provided 73% of this amount.

The new BankTrack research accompanies the launch of the ‘Banks: Quit Coal‘ campaign that aims to pressure commercial banks to cut their ties with the coal industry and instead divert capital to clean energy and energy efficiency. A new ‘Coal banks’ website, also launched today, provides extensive data about the banking industry’s ongoing deep links with the coal industry, and gives people around the world an opportunity to directly encourage banks to finally end their coal financing.

Yann Louvel, BankTrack’s Climate and Energy Campaign coordinator, said:

“The new BankTrack data issues a timely warning to the public and global decision-makers alike that rising coal financing, via banking giants like JPMorgan Chase, Citi and RBS as well as an increasing number of Chinese banks, continues to provide a vital lifeline to the increasingly beleaguered coal industry, while at the same time placing the planet in climate jeopardy.

“This is the most extensive data ever compiled on commercial bank financing of both coal mining and coal power, and even though we’re probably only covering little more than half of the global banking sector’s true financial support for the sector, the conclusion is stark: the lending figures have been rising steadily since 2005, and last year was a record year.”

Alex Scrivener, policy officer at the World Development Movement, said:

“At precisely the time we need to be rapidly pulling back from coal in order to avoid the worst impacts of climate change, banks all over the world are fuelling a whole new round of more coal mines and more coal-fired power plants. Any notion of ‘ethical banking’ is incompatible with financing an energy source like coal. It’s not only a disaster for the climate, it’s also responsible for all manner of injustice inflicted on communities in the global south who have been devastated by the impacts of coal mining.”

Lucie Pinson, private finance campaigner for Les Amis de la Terre/Friends of the Earth France, added:

“These new ‘coal bank’ findings will also help galvanise the growing public enthusiasm for divesting from coal and other fossil fuels by exposing the huge disconnect between banks’ hype about their clean energy investments and aspirations, and their huge, still growing and much less talked-about support for dirty coal.

“It’s all well and good to be trumpeting the odd wind and solar investment here and there, as the banks do every year in their sustainability reports. But our new data shows how wedded the majority of the banking sector still is to polluting, climate-changing and outmoded coal – the very stuff that they refuse to publicise.”

Heffa Schücking, director of German environment group and BankTrack member Urgewald, commented:

“The evidence presented in the new BankTrack report is shocking when you consider not only that the IPCC is just about to publish its most robust scientific findings yet about the extent of man-made climate change and the widespread damaging impacts being visited on human and natural systems alike. But also that many of the biggest public banks, including the World Bank, have taken the welcome first step of largely pulling out of financing for new coal power projects. The onus is now very much on the private banks to follow suit, and quit coal for good.”